URIGGING THE ECONOMY

There has been an enormous increase in inequality over

the last four decades. This course will examine some of the policy factors that have

led to this increase. It will briefly review some of the dimensions of the rise in

income inequality, including the extent to which the increase is the result of a shift

from labor to capital. It will also compare changes in before-tax and after-tax measures

of income inequality, assessing the extent to which changes in the tax code can explain

the rise in inequality.

There has been an enormous increase in inequality over

the last four decades. This course will examine some of the policy factors that have

led to this increase. It will briefly review some of the dimensions of the rise in

income inequality, including the extent to which the increase is the result of a shift

from labor to capital. It will also compare changes in before-tax and after-tax measures

of income inequality, assessing the extent to which changes in the tax code can explain

the rise in inequality.

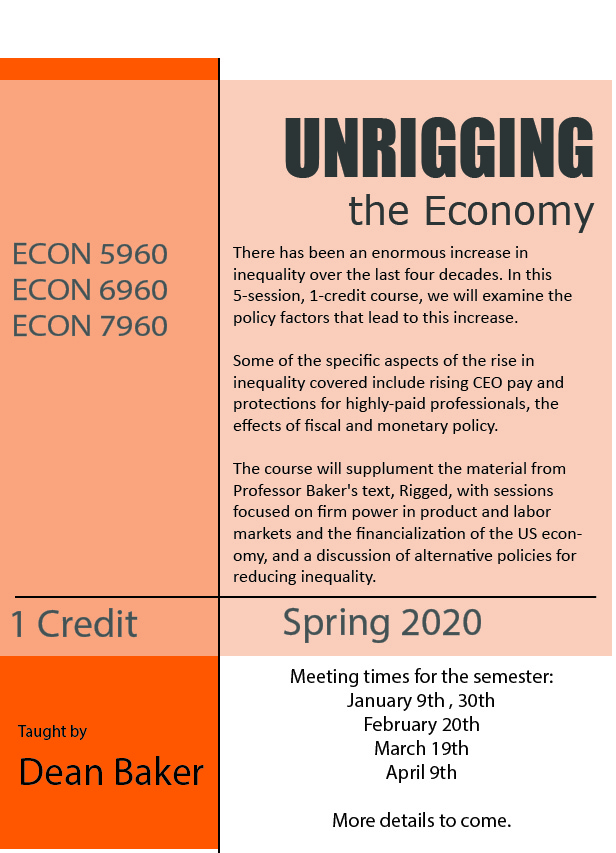

Other sessions will explore specific aspects of the rise in inequality. One will examine the explosion in CEO pay over this period and its impact on the wage distribution more generally. A key issue in this increase in pay is the extent to which it corresponds to the productivity of CEOs and other top executives or is due to failures in corporate governance.

Another session will examine the factors that act to protect highly paid professionals, such as doctors and dentists, from both foreign and domestic competition. Pay in these professions has far outpaced pay for typical workers. It also far exceeds the pay for their counterparts in other countries.

One session will look at the impact of macroeconomic factors, such as fiscal and monetary policy, on income distribution. Specifically, these policies not only affect employment and unemployment rates, but also the ability of workers to secure wage gains. The session will also discuss the impact of labor market institutions, such as unionization rates and employment protections on employment and wages.

Two further areas of focus will supplement the material from Professor Baker’s text, Rigged. We will consider the evidence for increasing firm power in product and labor markets due to monopoly, oligopoly, and monopsony market structures, the implications for inequality, and the policy tools available to address this trend. One session will extend the analysis of the institutional framework begun with the “Treaty of Detroit” to consider the Rigged topics covered in this Spring semester. A final topic will investigate the financialization of the US economy. The course will also consider how alternative policies can be structured to reduce inequality.